Car Taxes Ct Lookup

On that date interest will be charged from the original due date of July 1 2021. MONDAY THROUGH FRIDAY 830 am.

100 Free Illinois License Plate Lookup Get A Vehicle History Report

The first installment of Real Estate Special Service District Personal Property and Motor Vehicle tax on the Grand List of 2020 are due.

Car taxes ct lookup. This search will return only motor vehicle motor vehicle supplemental accounts. 866-703-0780 or by email. Make check payable to.

For immediate clearance please pay your balance in full by cash certified bank check or money order at the Tax Collectors Office. 01 - REAL ESTATE. To Search By Tax ID Search by Bill Number by entering the Grand List Year Bill Type and then Tax ID.

Connecticut Department of Motor Vehicles. Department of Motor Vehicles. If you choose to pay online your payment will be reflected and updated in 48 hours on the online system.

You may call 1-203-318-9523 to pay by phone. The City of Hartford Tax Collectors office has a new address where semi-annual tax bills with accompanying tax payments should be sent. Please see the Frequently Asked Questions FAQs regarding paying your tax bills online when you have delinquent motor vehicle taxes and need to register or re-register a vehicle.

If not paid by August 1 2019 interest will be charged at a rate of 1-12 per month from the due date July 1 2019 or a. Link year then link type and then link number. If mailing your tax payment please make your check payable to Trumbull Tax Collector and mail to Trumbull Town Hall Tax Collector 5866 Main Street Trumbull CT 06611.

City Services Finance Tax Collection View or Pay Your TaxesUtility Bill Online IMPORTANT NOTICE ON MOTOR VEHICLE TAXES If you have accessed this site to pay delinquent motor vehicle taxes AND you need CT DMV clearance for vehicle registration be aware that all payments made online will take 10-12 days to process and clear CT DMV. Please note delinquent motor vehicle or supplemental motor vehicle taxes cannot be paid with a credit card debit card or e-check if you need immediate clearance to register any motor vehicle at DMV. TAX COLLECTOR Walk-in office hours.

To Search By Tax ID Search by Bill Number by entering the Grand List Year Bill Type and then Tax ID. 12-144b payments must first be applied to the taxpayers oldest outstanding obligation by type of tax real estate personal property or motor vehicle DMV Clearances Per Connecticut General Statute 14-33 if motor vehicle taxes are unpaid you will not be able to newly register or renew any vehicle. Payment must be in the form of cash money order or certified bank check per town ordinance.

Current Tax Season Information. Box 412834 Boston MA 02241-2834. Box 5530 South Norwalk CT 06856 Include BOTH payment coupons with your payment.

Change of address drivers licensenon-driver ID renewals duplicate drivers licensenon-driver ID and driving history requests. Unpaid taxes are delinquent as of August 3 2021. Electronic checks will take 10 business days for clearance with DMV.

Welcome to the Town of Thomaston Tax Search tool. Note that payments made in person at the Tax. Motor Vehicles are subject to a local property tax under.

111 North Main Street Bristol CT 06010 Phone. July 1 2021 and payable on or before August 2 2021. Veronica Jones Tax Collector Tax Collection 45 Lyon Terrace Room 123 Bridgeport CT 06604.

Return to our homepage. To Search By Account ID enter account ID. All Due Now Balance Due IRS Payment Records.

- 400 pm effective May 20 2021. The new address is City of Hartford PO. You may also pay online using an electronic check E check ACH payment.

Tax Collector 31 Park Street Guilford CT 06437 Guilford has a full-time tax collector that works under the administrative direction of the state Office of Policy and Management the Board of Selectmen and town counsel. The first installment of Real Estate and Personal Property Taxes along with the Motor Vehicle Taxes due on the Grand List of October 1 2018 are due and payable July 1 2019. To Search By Account ID enter account ID.

New online services are now available. Please enter City Hall through the main entrance and follow the security guard. Delinquent motor vehicle and supplemental motor vehicle tax bills paid by creditdebit card will take 2-3 business days for clearance with DMV.

Check Property Tax Insurance and Other Issues. All Due Now Balance Due IRS Payment Records for Year 2020. Tax payments can be made online.

TAX COLLECTOR City of Norwalk. 203 576-7271 203 576-7172 Fax. Municipal Mill Tax Rates from CT OPM.

If you have received a bill form MTS you may contact them at this number. If any inquiry results in instructions to contact the Tax Collectors office please call us at 860 823-3760. You may use a debit credit or ATM card to pay on line or over the phone.

170 rows Town Property Tax Information. Monday Friday 900 AM - 500 PM. TAX COLLECTORs OFFICE HOURS.

The primary responsibility of this position is the billing for and collection of all tax. Motor Vehicle Tax Questions. Must enter Link Number.

Per Connecticut General Statute Sec. Tax Collector City of Norwalk 125 East Avenue Norwalk CT 06851. Bill Lookup Pay Online.

Town Of Orange Tax Bills Search Pay

Free Virginia License Plate Lookup Infotracer

Free Arkansas License Plate Lookup Infotracer

Free Oklahoma License Plate Lookup Infotracer

Connecticut Professional License Lookup Jobs Ecityworks

Arizona License Plate Lookup Vinfreecheck

Online Tax Bill Lookup Payments Bridgewater Ct

Free Vin Check California Vin Lookup Improv

Hawkland Survey Books Pdf School Library Books Books To Read Online Best Books To Read

Free Nebraska License Plate Lookup Infotracer

Free Indiana License Plate Lookup Infotracer

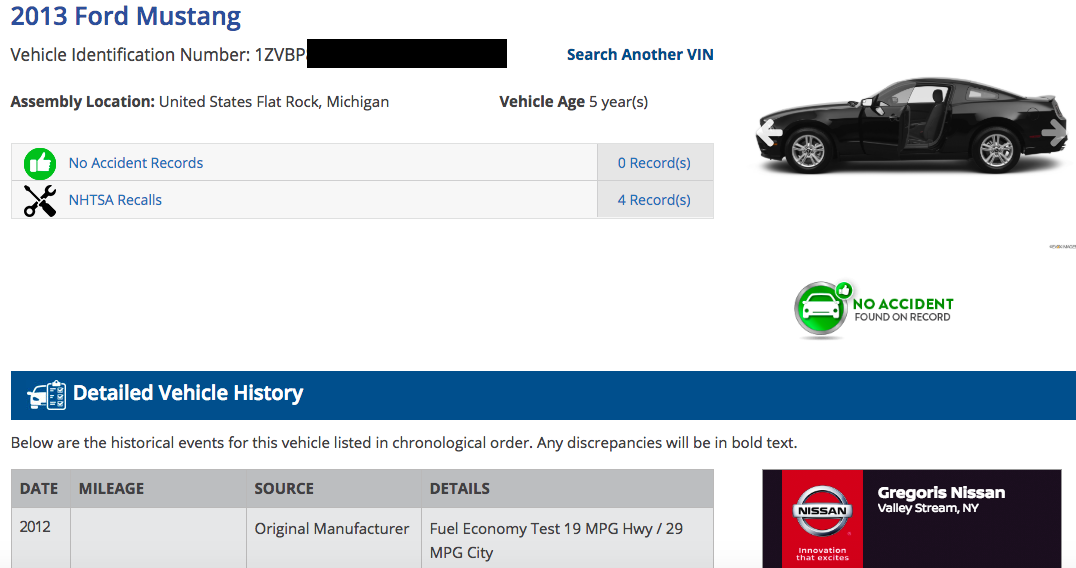

Dmv Vin Check And Lookup Free Vin Search And Verification

Free Georgia License Plate Lookup Infotracer

Town Of Rocky Hill Tax Bills Search Pay

Free Rhode Island License Plate Lookup Infotracer

Free Alabama License Plate Lookup

Post a Comment for "Car Taxes Ct Lookup"